interest tax shield fcff

Unlevered FCF cash the business has before paying its financial obligations. In a normal DCF where unlevered FCF is discounted the tax shield benefit is accounted for in the WACC where the pre-tax cost of debt is multiplied by the interest tax shield.

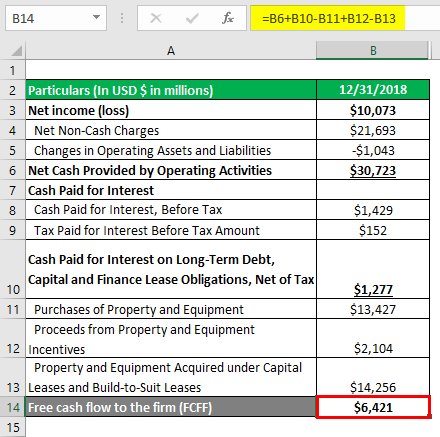

Fcff Formula Examples Of Fcff With Excel Template

NI Net income NC Non-cash charges I Interest TR Tax Rate LI Long-term Investments IWC Investments in Working.

. The tax shield is the amount saved in taxes by paying interest. Accordingly EBIT1-T also known as Net Operating Profit after Tax NOPAT is a measure of. Unlevered FCF cash the business has before paying its financial obligations.

A Tax shield is a necessary reduction in an individual or corporations taxable income achieved when. Starting from net income the following simplified calculation procedure is then applied. Include the tax shield benefit back in FCFD Free.

FCFF includes an interest tax shield as opposed to FCFE. In almost all books the free cash flow is adjusted for the effect of the tax shield. The effect of a tax shield can be determined using a formula.

They recognize the underlying expenses while calculating net cash Net Cash Net Cash represent the companys liquidity position and is. FCFF NI NC I 1 TR LI IWC where. If you dont want to add tax benefit of interest use unadjusted cost of debt.

FCFF net income interest 1-t and choose a discount rate of WACC with post tax cost of debt. To do that Interest with tax shield Interest 1 tax 701-25 525. Tax Shield Value of Tax-Deductible Expense x Tax Rate.

So when you add back. FCFF depreciation interest and tax shield. For FCFE on the other hand we start with net income a metric that has already taken into account the interest expense and tax savings associated with any outstanding debt.

So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240. FCFF Net income Non-cash charges Interests1-tax rate - fixed capital investments - working capital investments. So interest that we add back should be factored in for tax shield.

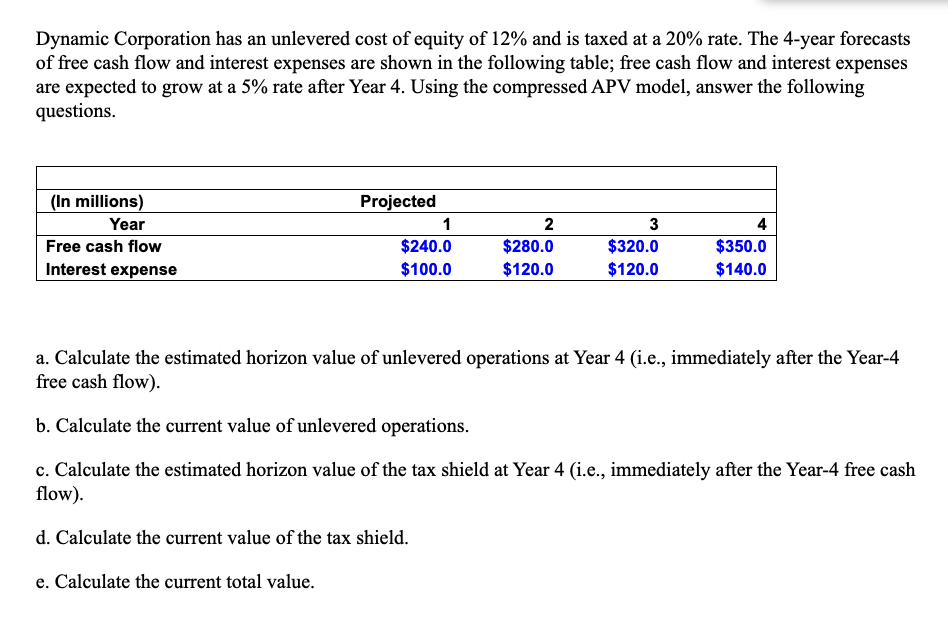

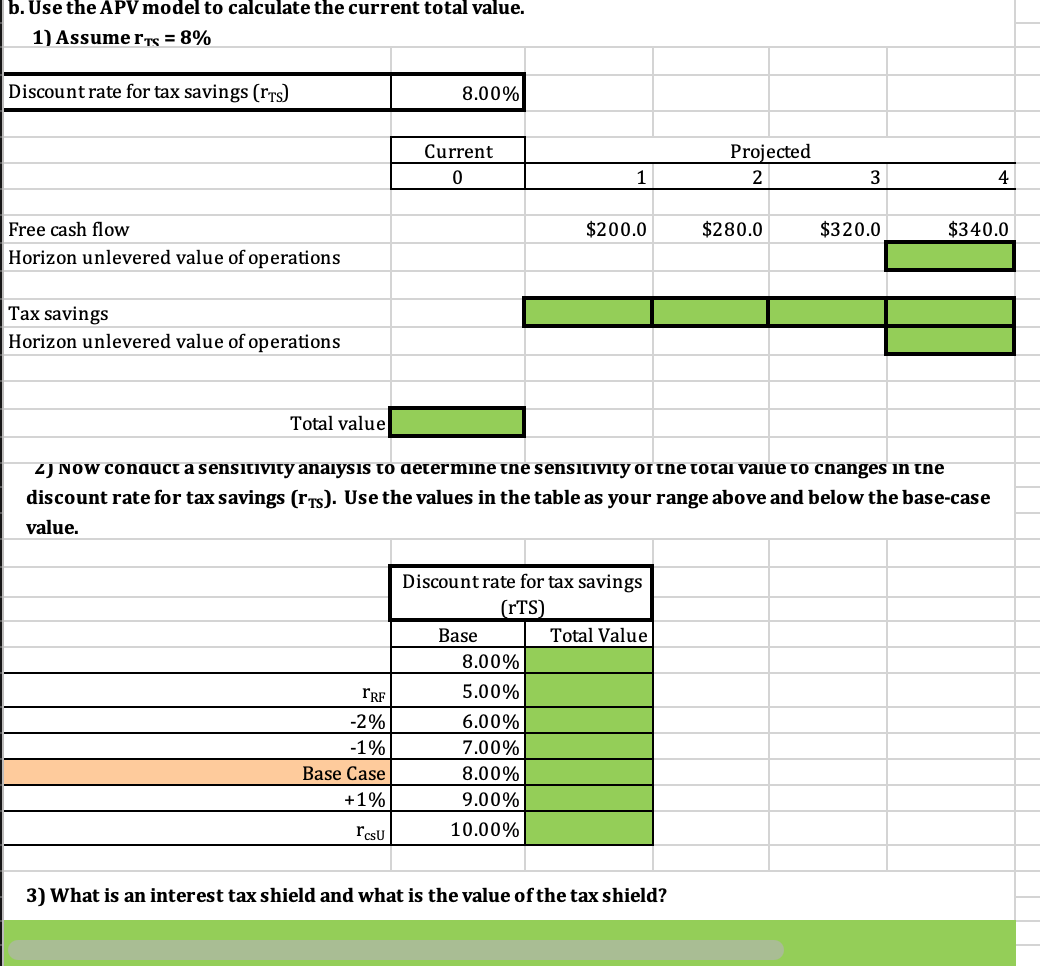

Solved Dynamic Corporation Has An Unlevered Cost Of Equity Chegg Com

Financecore Tax Shields Explained Youtube

Reading 35 Free Cash Flow Valuation Flashcards Quizlet

The 2013 Income Statement And Other Selected Financial Information For Company A As Well As Brainly Com

Tax Shield Meaning Importance Calculation And More

Why Are Tax Savings From Interest Ignored When Computing Free Cash Flow To Firm

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Part 1 Kasperov Corporation Has An Unlevered Cost Of Chegg Com

Free Cash Flow To Firm Fcff Formula And Calculator

Tax Shields Financial Expenses And Losses Carried Forward

Capital Budgeting Considering Risk And Leverage Ppt Download

Interest Tax Shield Formula And Calculator

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

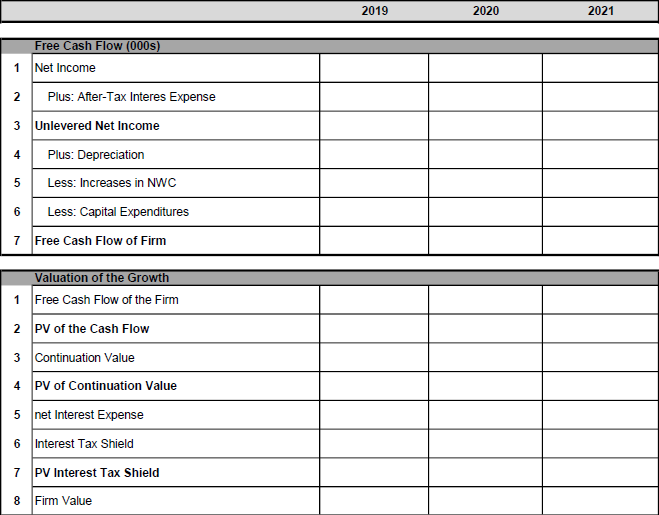

2019 2020 2021 Free Cash Flow 000s 1 Net Income Chegg Com

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Solved Question 2 With Taxes Harris Solutions Expects To Have Free Cash Course Hero

Discounted Cash Flow Analysis Street Of Walls

Forecasting Free Cash Flow To The Firm Fcff And Free Cash Flow To Equity Fcfe Cfa Frm And Actuarial Exams Study Notes